What is Money? Precious Precious Money

Before we get onto the somewhat daunting task of explaining cryptocurrency, let’s ensure we are aligned on the concept of money and a very brief history lesson. After all, it is always true that history is a good predictor of the future.

Since its inception, the form of money has been through several evolutions designed as improvements to fix a problem with the previous version. For a money system to be successful, it must optimise the balance between trust and ease of use. Not enough trust or not easy enough to use and people seek an alternative.

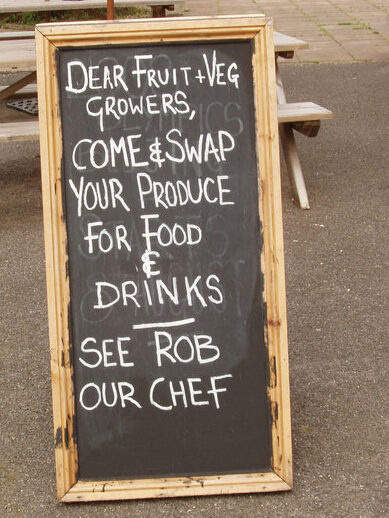

The established systems of money are never entirely eliminated. Some remote communities still leverage bartering systems to function. You will see examples of bartering around you in developed societies even though you may not consider it such. Ever swapped half your pizza with a friend’s? As people and businesses in developed societies try to live more sustainably you can find examples of more primitive forms of exchange.

Societies started by using various physical objects such as shells or salt to function as an intermediate currency to replace the direct exchange of goods or services. This eventually trended to precious commodities and eventually evolved to regularised coins made of precious metals like gold and silver. It is worth expanding on this first era of money as you might notice some similarities when I come to explaining Bitcoin. People trusted precious metals as a form of currency as the metal itself was considered to be valuable. Why? For starters it looked nice and shiny but importantly the value of these metals stayed relatively stable over time. This was because precious metals had a scarcity and relatively high cost, time and effort involved in mining and processing them for use.

People (wealthy people) eventually got tired of lugging around heavy bags of metal. To solve this problem, people used certificates that represented the amount of precious metals they owned. Goldsmiths stored people’s gold and in exchange they gave a paper note that the goldsmith issued for the respective value of their gold – practically speaking it worked like an IOU. This note could be exchanged with other people to buy things in the same way gold could but without needing to carry the gold around.

That all works well as long as people trust the paper notes and the goldsmiths that in essence worked like today’s banks. At some point, enough shenanigans were happening that governments stepped in and took control of the system. The paper notes in circulation were declared as legal tender back by governments. This was known as fiat currency and became the new trusted form of money. Gradually the notes in circulation were replaced with state issued coins and notes that were more difficult to forge. There is a bit more to it but this isn’t a history of money blog – there are plenty out there if you are interested.

Digital Money: In the words of MC Hammer. ‘You can’t touch this!’

Throughout the world, there are communities and people at different stages of the adoption of digital money. Digital money is fundamentally no different to the physical currency form of money that came before it and still works alongside it. Depending on where you live, your tech savviness, or your risk profile, you may have already ditched all forms of money in favour of using a mobile payment method on your mobile phone. There will be others among us that still head to your local bank and withdraw bank notes as the preferred method of using money because either they don’t know how (ease of use problem) or don’t trust the technology.

And while we are still adopting digital money across the globe, the next evolutionary wave of money is quickly gathering momentum. Unsurprisingly, the technology sector that has already transformed so much of how we live over the last couple of decades is now whipping up a storm to disrupt traditional money systems.

A leading influence in the creation of cryptocurrency comes from people who have lost trust in the highly centralised state and large institution controlled monetary systems. It might seem hard to believe when you listen to media coverage of the initial development of the cryptocurrency industry, but, like all evolutions preceding it, this latest innovation was conceived to deliver new levels of trust and ease of use for the future of money.

Cometh the Blockchain. Cometh Bitcoin. Cometh Cryptocurrency

History lesson over, now we get into understanding three key terms that sound all a bit technical. They are all intrinsically linked in that Blockchain was invented as part of the process of creating Bitcoin which was the first Cryptocurrency.

Let’s start with Blockchain. You shouldn’t need to understand Blockchain to use a cryptocurrency, but by understanding the basics, it should raise your trust levels in the idea of blockchain being a foundational system for future money.

Blockchain is a digital (i.e. computer based) ordered list of time-stamped transactions similar to what you may see on a bank statement or banking app view of your transactions. The difference between this and the sort of systems that your bank uses, is that this list is replicated and stored across 1000’s of computers. It is designed so that it is impossible to change any existing transaction once it is on the list. If it helps, you can say a new transaction ‘block’ is permanently added to the end of the ‘chain’ and then this unfamiliar name might start to sound vaguely logical. New transactions can only ever be added to the end of the list and are instantly verified and recorded by every computer that has a copy of the list. Additionally, anyone – that includes you once you know how – can inspect all transactions on this list. This prevents any improper creation of the records on the list.

So everyone gets to see everything happening?

Sort of. This may sound strangely transparent to allow anyone to inspect and review the transactions on the blockchain. It isn’t quite as clear as showing names or addresses of parties involved in transactions. The parties involved in the transactions are represented by unrecognisable, complex addresses which prevents them being very easily mapped to individuals. Complete anonymity is not necessarily desirable as that makes it easier to track or trace illegal activities. Opinions are naturally divided on this concept which is why people continue to iterate on the system to create alternatives.

That is the basic function of a Blockchain. The first blockchain was introduced to support Bitcoin, the first cryptocurrency. Bitcoin is still by far the most widely known, used and owned cryptocurrency. It is notorious as it is famous due to its widely publicised price fluctuations. Most people who know anything about Bitcoin will primarily know of it due to the media hype around its major and rapid price rise and fall events over its history. People don’t need to know much about something before they start following a trend with the result being some very big winners but also some very big losers. This hype fuelled behaviour, FOMO and jeopardy has been a tremendous influence on the cryptocurrency industry as a whole. It has distracted most people away from the purpose and values behind its invention.

Let’s try to get you to level 1 comprehension of how Bitcoin works? The Bitcoin system is set up like a finite game in that only 21 million Bitcoins can ever be created. It is both a competitive and collaborative game which completes when all 21 million coins have been created. Anyone can play the game for as little or as much as they want providing they have an appropriate computer. A player’s objective is to create, or mine, (not a coincidence) coins called Bitcoins. The game rules require all players to verify the creation of every other player’s Bitcoins. To mine a coin requires a player’s computer to solve increasingly complex mathematical puzzles. This process is called crypto-mining. The system dynamically adjusts the complexity of the puzzles based on the rate of coins being created and the amount that have already been created. The closer we get to the end of the game, the more complex the puzzle becomes which then requires more computer effort, which takes more powerful equipment, more electricity and more time. This makes it more expensive to create, or crypto-mine a Bitcoin.

This gamified setup might seem unorthodox, even bonkers, but it is a deliberate design to ensure the system’s security and integrity. It is unlikely to be a coincidence that there is a historical reference to the first era of money. The Bitcoin crypto-mining mimics precious metal mining through its use of resource scarcity principles. By making puzzles harder over time and thus restricting the rate of new coins entering circulation to a steady and predictable rate. It was designed to prevent any one player from flooding the market and devaluing the currency. This also means that Bitcoin mining becomes less about making quick money and more about contributing to a decentralised financial system’s security.

In 2021 came a perfect storm event that generated exponential interest and demand for owning Bitcoin. The game rules that restricted the supply meant that the unprecedented demand coming from institutional investment and adoption, broad media coverage, increased consumer interest and FOMO driven demand caused the price of Bitcoin to skyrocket. Astute investors took very large profits, prices started to fall and as quickly as it rose, confidence was lost and the price came back down. Since then, although volatile, the price of Bitcoin has steadily risen and we are back again at the point of higher than ever levels of interest, media coverage and ongoing developments in the cryptocurrency industry.

Remember that a successful monetary system needs to be trusted and have ease of use. Bitcoin was scoring pretty badly on that front if you asked most people. Trust not only comes from understanding how currency is managed and governed but also comes from having relative stability in its value. It is impossible to have a currency for day to day use if it experiences hyperinflation one week and hyper-deflation the next. You might be familiar with the news stories of early use of Bitcoin to buy coffee or pizza by people who in hindsight realise they spent the equivalent of $10,000’s on these items at current value. Instead of being used like money, Bitcoin became the fetish of investors and seen as a commodity asset they could be on whether the value will go up or down. It has remained a relatively volatile asset with many factors influencing the demand.

Beyond Bitcoin. What about the rest?

Despite its failings as a stable form of money, Bitcoin paved the way for a new wave of improvements and ideas for cryptocurrencies built on blockchain technology. Bitcoin was also the first and the emerging concept of Decentralised Finance – usually referred to as DeFi – a new form of finance that no longer relies on traditional financial institutional intermediaries. New cryptocurrencies are continually being developed. Safe to say, some are more useful than others. Some are developed to drive currency use case improvements such as greater anonymity, faster transactions, lower environmental impact, or more. Others have been created to enable entirely new applications and some for the sole purpose of creating a virtual asset to make money. This is where things start to seem a little more overwhelming. To avoid first-article bamboozlement, I’m going to leave explaining other cryptocurrencies for another article.

Feeling More Coinfident?

At this point you should be able to feel more confident to

-reflect on the evolution of money through various forms

-explain the concept of Blockchain and how it is different to traditional monetary systems

-at a stretch, explain how Bitcoin system operates and what factors influence its price

That is your alt-coin sized chunk to get you grounded for further learnings. Wait, what’s an alt-coin?! Don’t get ahead of yourself just yet. Take a breath. Enjoy what you have learned and when you are ready we explain that here.

The crypto-verse is indeed a daunting and complex place. We firmly believe that in some form, it will be here for the long term and so we want to help demystify the concepts and language so you can gradually grow your crypto coinfidence.